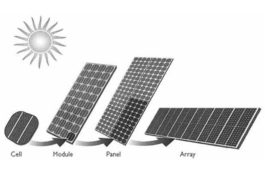

All solar equipments and its parts including panels, cells and modules would be taxed at 5% under GST

The government is planning to bring down GST rate on solar panels or modules to around 5 per cent as against 18 per cent declared earlier. The government’s recent announcement of 18% tax rate under the new indirect tax regime for solar module was the biggest surprise for the power and renewable sector. Looking into […]