Highlights :

- The European Union (EU) is set to fall far behind its ambitious energy transition targets for renewable energy, clean technology capacity and domestic supply chain investments, according to Rystad Energy research and modeling.

Co-located Battery Storage With Solar Can Help India Avoid Electricity Shortages: Report

Co-located Battery Storage With Solar Can Help India Avoid Electricity Shortages: Report Several European Union (EU) battery manufacturing companies are now shifting their interests to the United States (US). Better tax credits benefits and pro-renewable policies of the western country seem to have attracted several of them to look towards the US for better returns. A recent report by a global energy think tank Rystad Energy indicated this transition.

The Rystad Energy report indicated that unlike China, the European Union’s (EU)’s investment towards their net-zero targets are lesser. This, the report said, could create hurdles towards achieving its clean energy targets. EU plans to reduce 92% of its emissions from by 2040 and go net-zero by 2050.

However, the migration of its battery makers hint towards another challenge the block is set to face. The report attributed this trend mainly to the tax credit benefits of the US Inflation Reduction Act (IRA).

“Some European battery manufacturing companies are favoring the greener pastures across the pond, emphasizing the need for competitive developer conditions. For instance, FREYR Battery, originally based in Norway, has relocated its headquarters to the United States and is setting up a gigafactory in Georgia to benefit from the Inflation Reduction Act’s tax incentives,” the Rystad report said.

The Rystad Report talks about the global investments towards net-zero targets.

It also added, “Volkswagen, after its initial heavy investment in Northvolt, is now exploring opportunities in Canada to align with the IRA and maximize tax credits, illustrating a broader trend of shifting manufacturing to capitalize on favorable policy environments and sending a clear signal to policymakers.”

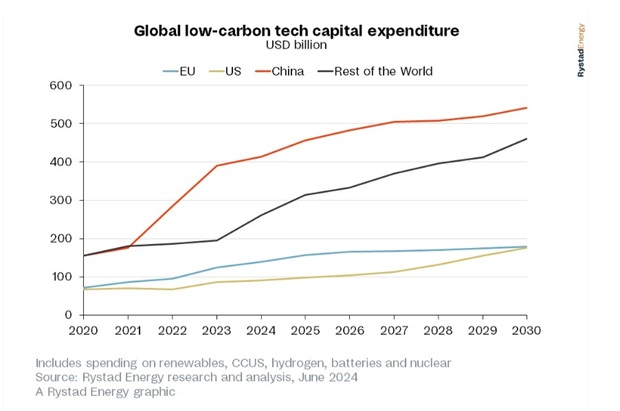

The European Union (EU) is set to fall far behind its ambitious energy transition targets for renewable energy, clean technology capacity and domestic supply chain investments, according to Rystad Energy research and modeling. The bloc’s capital investments (capex) in clean technologies – including renewables, carbon capture, utilization and storage (CCUS), hydrogen, batteries and nuclear – totaled $125 billion in 2023, dwarfed by China’s spending of $390 billion in the same sectors.

The US is currently behind the EU in annual clean-tech spending, investing $86 billion in 2023, but the Inflation Reduction Act is set to spur investments while the EU’s spending will plateau in the years to come. The US will all but match the EU in total clean energy spending in 2030, and accelerate past the bloc in the ensuing years.

The Net-Zero Industry Act (NZIA) was passed by the EU earlier this year as a roadmap for the Union to meet its lofty goal of cutting emissions by 92% compared to 1990 levels by 2040 and reaching net zero by 2050. As a direct response to the US’ landmark Inflation Reduction Act, the EU has set ambitious targets through the NZIA to support nascent industries, homeshore supply chains and position the bloc as an attractive investment location through supplier incentives. However, the cleantech investment landscape in the EU is a contrasting story of ambition versus reality, and another dose of reality could be coming soon.