Highlights :

- Higher prices and restrictions have stymied growth after Q2 in India.

- The situation is likely to be exacerbated by March this year, as a large number of projects will cross deadlines to either surrender allocations or cancel, if they can’t build.

Solar growth in India

Solar growth in India India’s solar growth, that is aiming for a target of over 25 GW between this year and 2030 to meet national targets on installed capacity, appear to be shifting to the slow lane, yet again. Industry players blame the slowdown on everything from higher prices, to policy, to rising cost of capital and more.

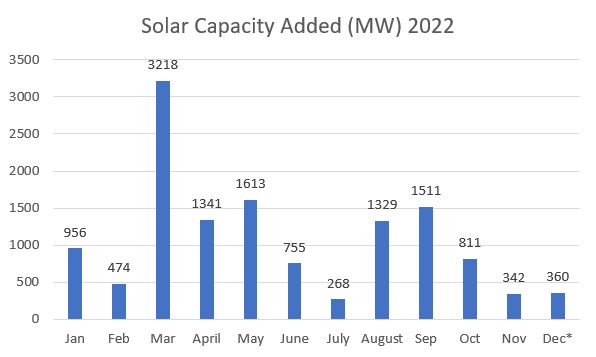

Solar Capacity Added In 2022

*estimates

After a strong start to the year, driven partly by a rush to order and even stockpile imported modules from China before the new duty regime kicked in, actual capacity additions have been slowing down, with no recovery in sight yet, since July this year. November saw just 342 MW of capacity additions, with December reporting only small additions so far.

These numbers, even lower than the figures for the corresponding month in 2021, paint a grim picture of slowing installations, with no clear idea on a revival.

The year on year growth of 26% that we will see this year is a far cry from the over 40% growth that was widely expected, leading up to a consistent 25% growth rate leading upto 2030. Now, even on the smaller base, those growth figures seem in jeopardy. Current capacity, for reference, has inched to over 62 GW, when the target for the Financial year ending March 2023 was 100 GW.

Industry insiders, while pointing to the immediate impact of the BCD (Basic customs duty) that came in on modules and cells, besides the wider ambit of the ALMM conditions, point to the inevitability of this slowdown. “This was expected, once the government made it clear it would not change its stance on the duties or offer exemptions to older projects. By announcing their plans a year in advance, I think they had provided fair warning too”, says one small developer who didnot want to be named.

Even as domestic capacities under ALMM have surged to almost 20 GW, and set to cross the 25 GW mark this year, large developers are struggling to push harder, owing to the prices on offer. Domestic manufacturers on the other hand claim that it is not just the duty protection that has driven up prices, but the steep hike in input costs that have been seen everywhere.

But large developers are not buying it. They claim that many projects are simply unviable at current prices, and prices in international markets remain much lower. They also cite rising finance costs as a major worry. Many would rather that the government provide incentives for domestic manufacturing, rather than go with the high tariff protection route to support domestic manufacturing industry.

One area which seems to be providing a silver lining, and more hope for the future is rooftop solar. Almost everyone we checked with claims interest, and orders remain high, and this segment is not as sensitive to pricing tweaks as the large utility segment. The C&I segment is another segment that is capable of delivering upto 3 GW and more each year, says a leading developer. With more financing options, the segment could take off in a big way. Besides, players like ReNew power have been pushing out in this segment to seek higher margins in any case.

But with the lion’s share of capacity additions tied to utility scale plants at least till 2025 and more, the slowdown is bound to take a huge chunk out of annual targets, and make reaching the 2030 targets that much more difficult. The big challenge it seems will be to translate central government intent to action at the state level, where far too many states are not considering these targets with the same urgency as the central government would wish them to. Initiatives like the green hydrogen push which will create fresh demand for dedicated renewable capacities, are only expected to deliver from 2025. All in all, 2023 seems at serious risk of being a wasted opportunity on the solar trail for India.