FDRE Projects Prone To Several Financial Risks, Says EMBER

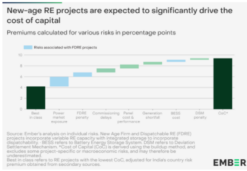

FDRE Projects Prone To Several Financial Risks, Says EMBER A new report from Ember maps various financial risks associated with renewable projects. Based on the assessment of these risks, the report estimates the premiums associated with them and the overall impact of the risks on the cost of capital. The report moves beyond traditional “thumb rules” for calculating risk premiums by adopting a data—and modeling-driven methodology.

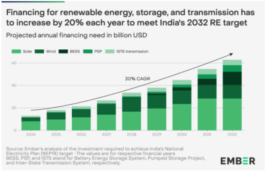

India’s power sector transition requires a significant increase in financing, with annual investment flows needing to grow to USD 68 billion by 2032 to meet the National Electricity Plan (NEP-14) targets and achieve India’s 500 GW renewable energy goal by 2030—requiring a 20% compounded annual increase from current levels.

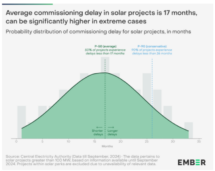

Project commissioning delays

Project commissioning delays and uncertainties due to the specific characteristics of new-age Firm and Dispatchable Renewable Energy (FDRE) projects are expected to have the greatest impact on the cost of capital. The analysis suggests that risks due to a combination of both could increase the cost of capital by up to 400 basis points. Commissioning delays have been caused by land acquisition bottlenecks, grid connectivity delays, and delays in power purchase agreement (PPA) signing. These delays have averaged 17 months, with projects in some cases extending even up to 26 months and beyond.

Financing Renewable Energy Project

Additionally, FDRE projects, designed to enhance renewable energy dispatchability, introduce unique financial risks. These risks are mainly attributed to penalties for not meeting the required Demand Fulfilment Ratio (DFR) and exposure to wholesale market fluctuations. Excess electricity from FDRE projects—ranging from 25% to 45% of the contract requirement—is sold in the wholesale market, thus exposing developers to price volatility and potential price cannibalization. Uncertainties around future battery replacement costs could also impact the financials of the project.

cost-to-capital of the project

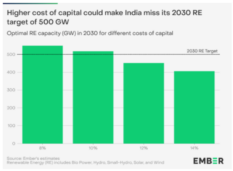

The analysis further suggests that a 400 basis points increase in financing costs could result in India falling short of its 500 GW renewable energy target by up to 100 GW. An elevated cost of capital would also increase the cost of electricity for consumers.

High cost for renewable energy target

Project Commissioning Delays

This report emphasizes that addressing commissioning delays through streamlined land acquisition laws, developing solar parks, and introducing standardised power contracting processes can significantly reduce uncertainty around project timelines. A significant portion of revenue uncertainty in FDRE projects related to exposure to wholesale market price fluctuations can be mitigated through structured risk-sharing contracts, such as contracts for difference (CfDs).

Additionally, intentionally deploying storage capacity greater than minimum mandates can reduce the risk of not meeting specific demand requirements. However, the flow of concessional finance to FDRE projects would be crucial in the near term to keep the cost of capital manageable until early projects are commissioned and a track record is established.

average-commissioning-delay

EMBER Analysis

Neshwin Rodrigues, Senior Energy Analyst for India at Ember, emphasised the need for targeted mitigation measures: “Understanding project-specific financing risks for RE projects is key to designing targeted mitigation measures that keep the cost of capital low. Staying attuned to evolving risk profiles in renewables is essential for sustaining their growth and ensuring India meets its RE targets.”

Duttatreya Das, Energy Analyst for India at Ember, highlighted the value of structured risk assessment: “Besides offering a detailed assessment of key risks in India’s renewable markets, this report presents a transparent risk premium assessment methodology for renewables. By demystifying the quantification of risks and their magnitude, it ensures that all RE stakeholders—developers, financiers, and policymakers—have access to a structured framework for evaluating risks. This, in turn, can lead to more targeted policy interventions and contracting mechanisms that effectively mitigate risks, ultimately supporting the affordability of renewable energy. ”

Satyadeep Jain, Director of Equity Research at Ambit Private Limited, pointed to inefficiencies in the contracting process: “There has been a surge in Letters of Award (LoAs) for renewable energy projects, but only a few have materialized into Power Purchase Agreements (PPAs) so far. The Ministry of Power (MoP) must address this issue, as the delay imposes financial strain on developers due to bank guarantee (BG) costs and creates uncertainty for equity investors in forecasting cash flows based on LoAs.”

Abhishek Jain, VP, of Investment Cell at O2 Power, emphasized the importance of keeping risk assessments up to date: “Risks in RE projects are constantly evolving, making a contemporary understanding crucial for developers and investors. Research like this must be regularly updated to quantitatively reflect the evolving risk profile.”