Highlights :

- The strong European show follows projections of a 33 GW solar year in the US.

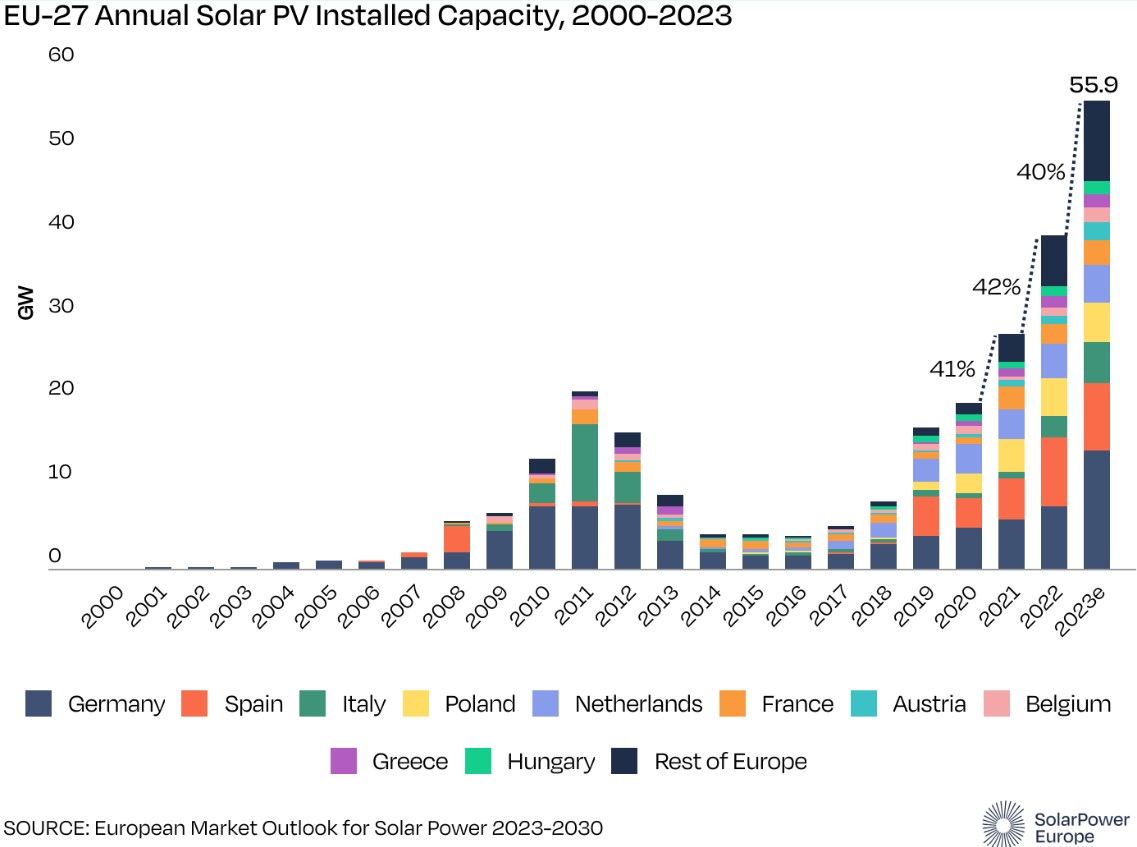

- SolarPower Europe’s new European Market Outlook for Solar Power 2023-2027 reveals a record 56 GW of solar installations in Europe in 2023. This marks the third year of annual growth rates of at least 40%.

- The annual report predicts slower growth in 2024, with the annual market set to increase by only 11% – delivering 62 GW.

Continuing a third straight year of over 40% growth, Europe is set to add 56 GW of solar capacity in 2023. The data comes from SolarPower Europe, the trade body representing the European solar industry. The report also cautions that the continent might be pushing the limits of its ability to absorb solar capacity, as it expects growth to slow down to 62 GW in 2024, an 11% increase over 2023.

The report, ‘European Market Outlook for Solar Power 2023-2027’, says that 2023 is on track to deliver increases in installed capacity in nine of the continent’s top ten solar markets. 2023 also marked a new era for solar in Central and Eastern Europe, with three newcomers reaching the threshold of at least 1 GW of solar a year; Czechia, Bulgaria, and Romania. SolarPower Europe claims that the solar additions have played a key role in combating the gas crisis caused by the Russia-Ukraine war that rocked European households and industry through 2022.

Europe actually needs to install 70GW annually to meet our 2030 solar target, said SolarPower Europe CEO Walburga Hemetsberger.

Additions By Key Regions

Germany, which had been overtaken by Spain in 2022, is expected to make a strong comeback to the top in Europe in 2023, by close to doubling additions to 14.1GW during 2023, even as additions slowed down in Spain to 8.2 GW. Italy (4.8 GW), Poland (4.6 GW), and the Netherlands (4.1 GW) round out the top five in the continent during 2023.

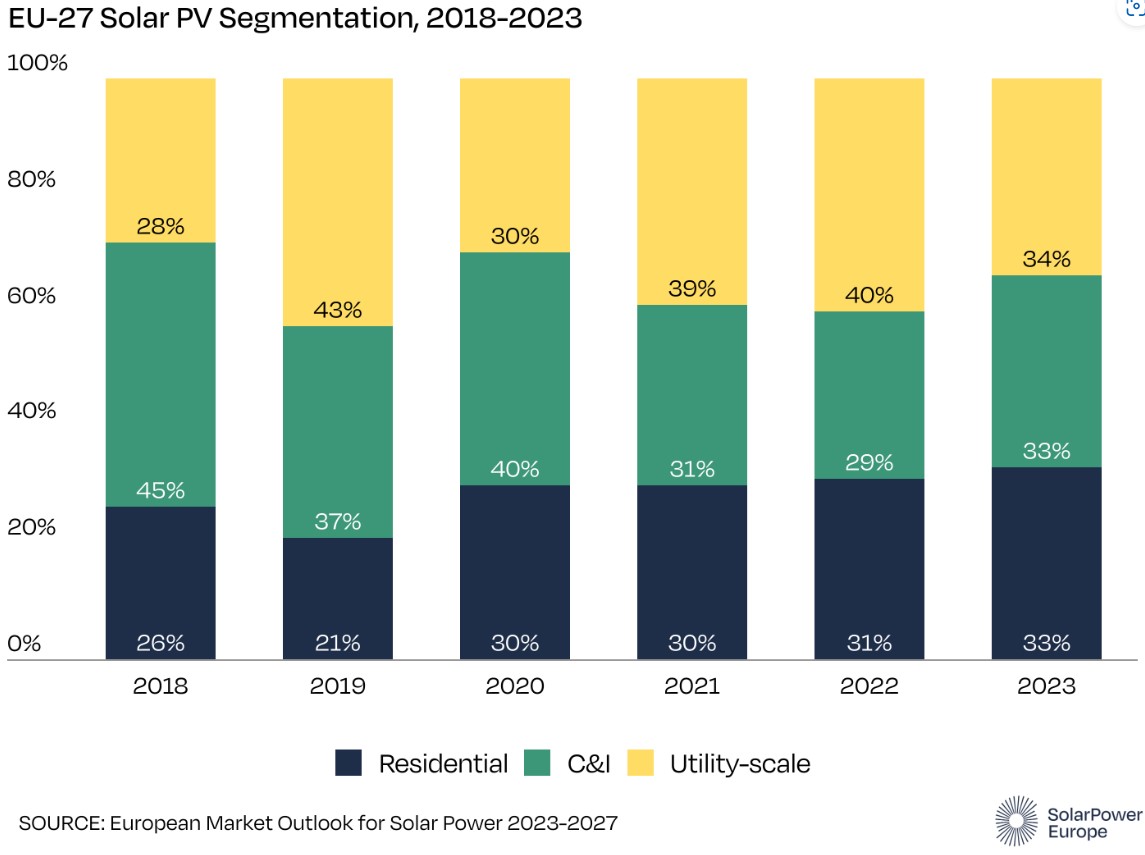

Interestingly, the report highlights that utility-scale and residential solar to an extent are finally contributing significantly in Europe as well, underlining how massive volumes are possible only with utility scale additions to the grid. After being led by the Commercial and Industrial (C&I) segment till 2022, in 2023, the solar sector is expected to be divided equally between these three segments, with utility scale edging ahead at 34%, versus 33% for the other two.

Europe’s Manufacturing Push

Despite headline grabbing announcements and plans being announced, the solar body expects Europe’s manufacturing renaissance, if it happens at all in solar, to be a reality only by 2030. The initial target of having 30GW of annual polysilicon, ingot, wafer, cell and module manufacturing capacity domestically in Europe by 2025 is considered off the table now. Currently, the report claims that less than 2% of Europe’s current demand for solar could be met with European-produced solar PV.

Polysilicon manufacturing where European firms already have the capability of producing 26.1GW of materials per year is flagged as a key area to watch, but the other parts of the supply chain, namely, ingot, wafer and cell manufacturing sectors that are currently at 4.3GW of components annually, remain well behind ambitions. However, module manufacturing currently stands at around 14.6 GW, 59% higher than 2022.

On inverters, with a capacity to produce 82.1GW of inverters per year, Europe is much better placed to consider even export markets. Interestingly the body has referred to the US Inflation Reduction Act and India’s own Production Linked Incentive schemes as programs to emulate possibly for further incentivising manufacturing in Europe.

The group also notes that the European solar sector will need to employ one million people by 2025, up from around 648,000 in 2022, to support the growth of all parts of the continent’s solar supply chain.