Since April started, India’s renewable sector has presented an observer with two contrasting camps. On one side are solar module, and some cell manufacturers, who look forward to good times with the tightening of restrictions on Chinese imports. On the other are the developers, the first few of whom have already started indicating the risk to closing future deals as the downward trend in prices has been brought to an abrupt halt from April 1.

While these two camps slug it out on social media, especially Linkedin, it’s a good time to consider another issue that might become a major cause for concern in time. The small matter of interest rates. The latest inflation data in the US that knocked out any possibility of an interest rate cut there has also meant that India’s own central bank is unlikely to rush in to cut rates itself.

Waiting for a direction change

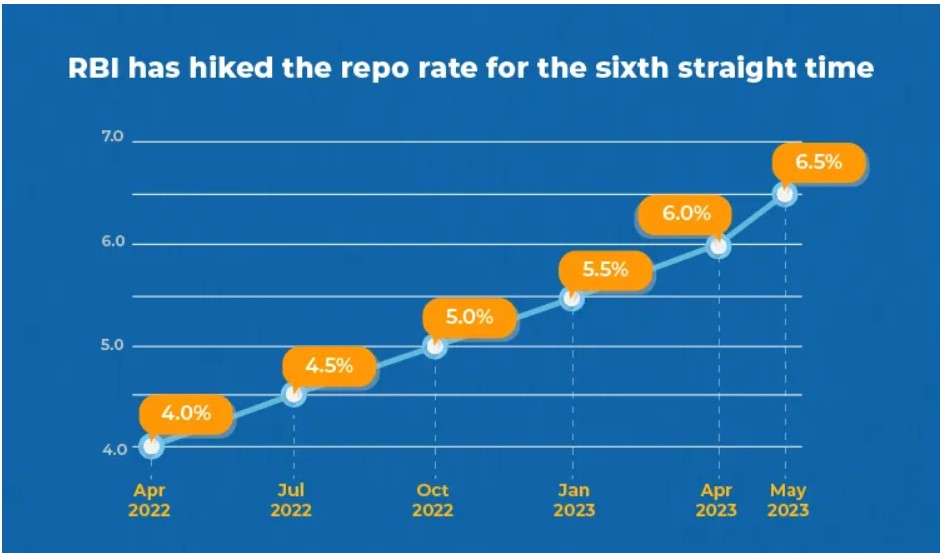

While by no longer high compared to historical trends, the RBI which last hiked its key repo rate in February 2023 to 6.5%, was widely expected to start a rate cut cycle from June this year. This was after it started hiking rates from May 2022, post the pandemic inspired cuts when it followed global trends.

A distinct feature of India’s renewables growth has been the high private sector participation in it. We have seen how a combination of low interest rates, price drops and supportive government policy drew investor interest to the sector resulting in a huge jump in solar and wind power development. With a global pace that is expected to be 25% per annum right till 2030, it would appear everything is in order. But current interest rates and future increases in costs could add an unacceptable amount of risk for many investors.

For solar projects in particular, even as the rate cycle had turned in 2022, investors have managed to ride through it thanks to dropping module costs, the largest component of solar projects at 50-60%. Inflation and higher cost of capital resulting from higher interest rates especially outside China is placing strain on some plans now, as module prices start rising.

With the large upfront costs of renewables (offset by lower operational costs), the higher cost of financing is a real issue to manage now for developers, with the indications being clear that the US Fed may hold off any interest rate cuts till mid-year, assuming inflation data holds up. Inflation sustaining itself or even going up due to the current flare up of tensions in West Asia and the still unresolved Russia-Ukraine war simply adds to the risks of even that cut being delayed further.

In the US, the effects are already being felt in the home solar segment. New installs could go down by 13% in 2024, as forecast by the industry developer group Solar Energy Industries Association (SEIA) and consulting firm Wood Mackenzie. Solar Insure, a firm that monitors residential solar additions, claims that over a hundred solar contractors have gone out of business in the past year as demand dried up. In fact, longer term issues like solar curtailment or the reduction in incentives for solar buyers have made the situation worse, as states, especially California and soon, Texas, grapple with the issue of handling high solar generation. The only reason why actual ROI is not hit yet is the rise in grid energy costs in the meantime, especially since 2021.

For India, the lessons are critical to absorb and use for its own roll out. While the PM Suryaghar Yojana has been rolled out to a strong response, the sustained growth in solar will be driven by financing, like all developed markets. Higher interest rates could be a dampener to those growth plans, besides making the government’s own calculation go awry when it comes to the loans being offered currently.

A booming stock market has helped large developers like Adani Green, Tatas, and more seek faster growth, including by borrowing more from domestic banks, who are also on board with the solar push finally. A significant hike in costs linked to interest rates, not to mention the return of rising costs on the equipment front thanks to ALMM, is a developing risk for a target of 25 GW annually from here on, especially after the country eked out a 15 GW installation figure in FY24 against the odds. On the other hand, a cut in rates will be a very timely support against rising costs, helping support growth like almost nothing else.