Q2: Borosil Renewables’ Exports Accounted For 13% Of Turnover

Q2: Borosil Renewables’ Exports Accounted For 13% Of Turnover Solar panel glass manufacturer Borosil Renewables has announced that it will invest Rs 1,500 crore over the next two years to expand its capacity by nearly 2.5 times and supply glass for 15 GW of solar modules by FY25.

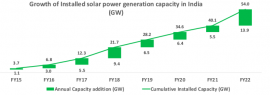

As of March 2022, India has around 15 GW of solar module manufacturing capacity. Due to stiff competition from low-priced imports and low installations, the actual utilization of the domestic manufacturing in the country is about 6 GW annually (about average 40-45% utilisation). However, this trend is expected to change with a favorable policy framework, which will help create enablers for investments into domestic manufacturing. About 37 GW new capacity expected to be added by various existing and new players taking the capacity to over 50 GW.

“We are doubling down on our investments because being the first and the only domestic manufacturer of solar panel glasses we see sky is the limit for demand. Accordingly, we are investing another Rs 1,500 crore to take our capacity to 1,550 TPD by FY24 and to 2,100 TPD by FY25 which will help us supply 15 GW of solar modules,” Pradeep Kheruka, executive chairman of Borosil Renewables, told a news agency.

It is worth noting that the share of solar in renewables in India is increasing: Out of total installed power generation capacity of 399 GW as of March 2022 in India, renewables form around 27% of the same (110 GW) of which solar (54 GW) is about 49% of the renewable capacity. While the target for solar has since been raised to install 300 GW by 2030, FY22 witnessed the highest annual installations.

Borosil also plans to invest in its latest German acquisition – Interfloat Group to increase its capacity to 500 TPD (Tonnes Per Day) from 300 TDP now by 2023, “With these capacity augmentation, by FY25 we will be able to supply 2,600 TDP of solar panel glasses that can generate 15 GW of power and make us the largest non-Chinese-owned company in the world,” Kheruka said, adding all the domestic expansion will be in and around the company’s Baruch facility in Gujarat.

Interestingly, the anti-dumping duty levied on the Chinese solar glass is due to end in July. Borosil states that it has already applied for an extension of the same because there is no change in the circumstance. “They continue to dump, and we are awaiting the result of our application,” argued Kheruka.

The Borosil Group firm had announced the acquisition of Interfloat Group in late April– the largest solar glass manufacturer in Europe — for 55.5 million euro. The deal involved an upfront cash payout of 30 million euro, and 22.5 million euro through issuing of fresh equity (by Borosli Universal) and 50 per cent sharing of earned profit from 2023, a top Borosil official said. The acquisition, besides obvious synergies in a wider client base and presence in Europe, will add an immediate Rs. 525 Cr topline to BRL and an additional about Rs. 350 Crore after the expansion of the capacity from 300 TPD to 500 TPD in Europe by the end of CY23.

Last week, the company declared its results for Q4 of FY 2021-22, having enjoyed a very strong resurgence in prospects and financials over the past two years as demand has grown worldwide. Borosil reported total income of Rs. 182.3 crores during the period ended March 31, 2022 as compared to Rs. 174.25 crores during the period ended December 31, 2021. Net profit came in at Rs. 46.3817 crores for the period ended March 31, 2022 as against net profit of Rs. 45.73 crores for the period ended December 31, 2021. For the full year, revenues were up 28% at Rs 644.2 crore, while net profit was up 85% at Rs 165.8 crore.

Kheruka recently pointed out the structural shifts in the demand for solar glass on the back of technological changes in solar cells and modules. The module sizes are becoming larger and there is growing preference for bifacial modules, using two glasses in each module as against one in the case a conventional module. As a result, there is a shift in favour of thinner glass of 2mm globally. “Borosil is equipped to meet this to a great extent and is also building significant capacities for such products looking at future growth,” he said.

Interestingly, the average ex-factory prices of tempered solar glass during Q4 FY22 were about Rs.141.5 per square metre, per millimeter as compared to Rs.112.9 per square meter, per millimeter during the corresponding quarter in the previous year. Asked whether he sees the prices tapering off or rising in the next couple of quarters, Kheruka responded, “This is a very difficult question to answer. I simply cannot have any guess on this matter. Our prices are dependent on the international prices and what turn they will take is something which is truly speculative. So, I would not like to have any guess on this.”

“On one hand the prices of inputs have risen and on the other hand the solar glass export prices from China have declined in the last few months. This is likely to cause a moderation in the margins for the company and also for the competition,” he added.

The Borosil Group was founded in 1962 in collaboration with Corning Glass of the US and comprises two publicly listed entities — Borosil and Borosil Renewables.

Borosil manufactures around 600 consumer and laboratory glass products such as laboratory glassware, pharma packaging, microwavable kitchenware, and now cookwares tableware and solar glass at its Jaipur, Nashik, Pune and Tarapur plants.