Highlights :

- Bringing in PSUs for the PM Suryodaya scheme is the equivalent of the heavy artillery being brought to battle. But many challenges remain.

- For these PSUs, tackling the rooftop targets given to them will change them in many ways, truly making them nation builders being the most important.

The MNRE’s January 25 Office Memorandum, where it allocated states to specific PSUs for pushing the ambitious new Rooftop Solar targets, throws up some very interesting questions. With a target of 10 million households, and upto 3 KW of solar for each, the Pradhan Mantri Suryodaya Yojana is potentially a game changer, offering an opportunity for almost 32 GW of rooftop solar capacity. A number that fits in rather neatly with the missing part of the 40 GW rooftop solar target by 2022, of which barely 11 GW is in place for now.

Rooftop Solar Awareness Issue? Solved

Financially, going by the broad benchmark costs of Rs 50,000/kW and other costs (with the CEA to provide region-wise cost benchmarks), financing requirements could be as high as 175,000 crores or approx.$20 billion, considering the promise that households will not have to pay anything upfront at all, with an enhanced subsidy of 60%, from the earlier 40% for households consuming upto 300 units per month. The imprimatur of the Prime Minister also guarantees the kind of attention for this that previous rooftop solar drives have, sadly, lacked.

In fact, we have already highlighted earlier how the scheme is likely to offer multifold economic benefits, if executed well. But is it a done deal? Not really, if we go by the history and ground situation today.

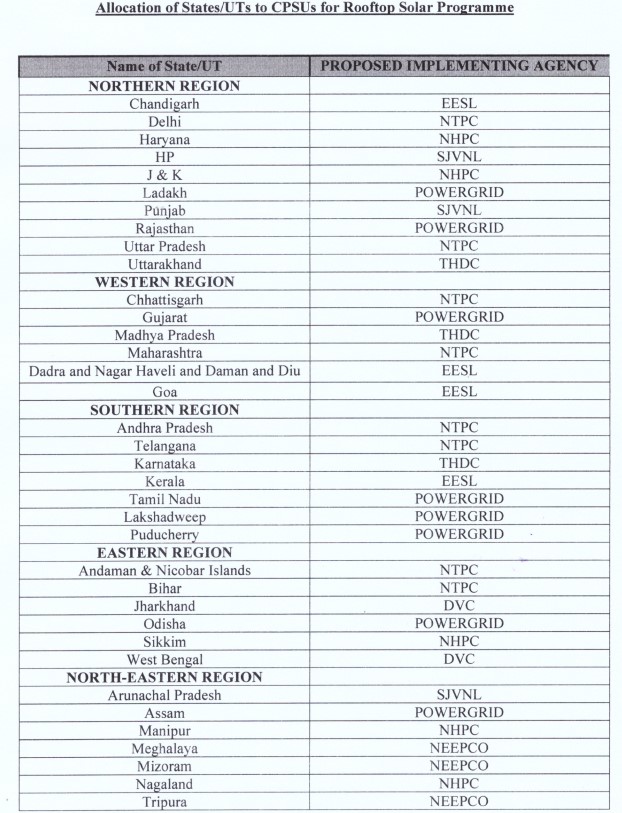

Two things stand out in the move to operationalize the new scheme. One, the roping in of PSU power and energy firms to ensure execution at ground level, by allocating specific states to each. These firms include EESL, NTPC, SJVNL, NHPC, Powergrid, NEEPCO, THDC and finally, DVC. Second, the government’s contention or ‘finding’, that previous efforts failed simply due to a lack of adequate vendor capacity.

Rooftop or Bust

The Challenge For PSUs

Let’s consider the most obvious challenge for the 9 PSUs that have been picked for execution. The Ninth of course being REC Limited, the power financing behemoth that is going to be the monitoring and implementing agency tracking progress. The most obvious disconnect is the fact that each and every one of these firms, have next to zero experience of dealing with retail markets, or consumers at a household level in their business. Thus, while they may know all about generating and distributing power and whatever it takes to do it efficiently, their writ has usually stopped at that, where state discoms take over. This lack of experience is no small matter, as micro-targeting and execution at household level is a whole new ballgame which many of these PSUs are not equipped to play. Or in many cases internally, frankly unwilling to play. This lack of expertise and focus could be a huge issue, as even REC, which will presumably be lending out a significant part of the funds for the scheme, has no retail experience.

A basic effort has been made to recognise this by the urging to each PSU to set up a separate SPV/subsidiary for the purpose. At PSU speed, that process itself might be challenge number one for many of these firms. On the positive side, the experience and learnings from the whole project could have a salutary, positive impact on these firms permanently, as they seek a longer term business vision and direction. NTPC for instance has repeatedly considered getting into the distribution business, before holding back.

Vendor Capacity-Hiding Other Larger Issues

The second issue of ‘vendor capacity’ also needs more attention. We don’t believe the issue is as big as it is made out to be. In a way, it is also a poor effort to lay the blame on inadequacies of private players to take advantage of previous government backed efforts for rooftop solar. As this publication has long argued, the issues are more fundamental in the form of discoms that are happy to drag their feet on faster approvals, lack of financing, poor awareness of subsidy options, and then, vendor capacity.

The PM’s backing takes care of the matter of awareness, that is for sure. Where work still needs to be done on a war footing is changing the orientation of discoms in many states, large and small. To that extent, for the mostly central government owned PSUs that already deal with these state government backed entities, communication should not be as much of a challenge as it is for private players. The recent push to streamline approvals by the centre, the operationalisation of the National rooftop solar portal and roping in REC Limited as implementing agency have sought to tackle these challenges. Larger challenges like incentivising discoms to coopt them into the targets, ensuring adequate expertise and training at ground level for implementation will need to be handled immediately as well, to make real progress at the pace desired.

Conclusion: While the assumption in many cases is that these new rooftop targets are for 2026, one has to say that seems out of the question at this moment. However, targeting, say, 2030 will be too unambitious. 2027-28 seems a far more likely possibility. Combined with continuing progress on the C&I front, we could actually be back on track to have solar rooftop capacity of closer to 65 GW by 2030 in that case. 10-11 GW per annum for rooftop solar? Indian solar manufacturers would kill for that sort of domestic demand for DCR products.

The decision to rope in PSUs should not be seen as a sign of desperation but rather as a positive signal of intent behind the rooftop solar push this time. To that extent, the old claim, “this time it is different’ does ring true. Central PSUs bring far more credibility in terms of basic knowledge, funding ability, and intent to pay on time to vendors in the private sector who will play a key role this time as well. Hopefully, we will see each doing enough to put the basics in place over the next few months in terms of the ability to reach out, tackle the mutual suspicion that exists, and execute and track progress on their respective targets. They will know that if they get it right, not only will they see the benefits on their bottom line, but they will contribute to building a much greener country and, equally important, a large cohort of technicians for whom the world will be an opportunity in the coming years as other countries look to India to fill the scarcity of their own skills.