Highlights :

- Green power trading is the trade of electricity produced using renewable means and other renewable energy commodities like biofuel.

- In India, the Indian Energy Exchange (IEX) and Power Exchange India Limited (PXIL) are major players in the market, using instruments like renewable energy certificates (RECs) and day-ahead and term-ahead contracts for the sale and purchase of power.

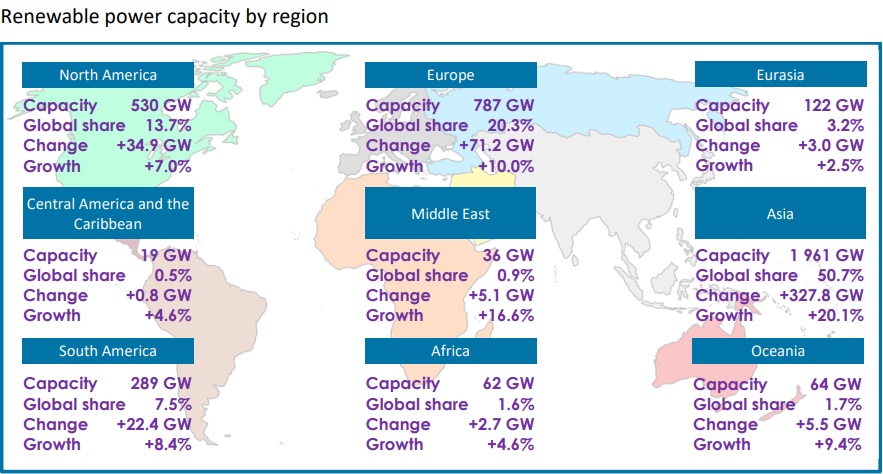

The world has witnessed exponential growth in the renewable energy sector, particularly over the last decade, as the importance of renewable energy has become common knowledge. According to one IRENA report, 2023 set a new record in renewables deployment in the power sector by reaching a total capacity of 3,870 Gigawatts (GW) globally.

Furthermore, renewables accounted for 86% of capacity additions. Consequently, similar to conventional energy, renewable energy has also become an integral part of every sector of the economy notwithstanding its inherent limitations. One such sector where renewables are making their presence felt is in the exchange of renewable energy in financial markets, also known as Renewable Energy/Power Trading or Green Power Trading.

What is Green Power Trading?

Energy trading, in the traditional sense, involves the exchange of energy commodities in financial markets. This includes energy commodities like crude oil, natural gas, and electricity. However, green power trading is the trade of electricity produced using renewable means and other renewable energy commodities like biofuel. Renewable energy includes solar, hydro-, wind and geothermal power, as well as bioenergy (biofuels) and marine energy.

How Does Green Power Trading Work?

Green power trading enables buyers to support renewable development by purchasing renewable energy or instruments like RECs through specialized exchanges or trading platforms.

India’s Ministry of Power introduced real-time trading in response to the fluctuations caused by integrating renewable energy sources. This system operates on a bidding model, divided into zones across India. Energy trading occurs on two platforms: the Energy Exchange of India and Power Exchange of India Ltd. These exchanges work closely with load dispatch centers to ensure consideration of transmission corridor availability. Oversight for these operations comes from the central electricity regulatory authority and Power Grid. Real-time power trading happens in 30-minute intervals, with auctions open for 15 minutes before market clearing.

Green power exchanges function similarly to commodity exchanges, facilitating transactions between renewable energy buyers and sellers through spot contracts for various timeframes. In India, the Indian Energy Exchange (IEX) and Power Exchange India Limited (PXIL) are major players in this market, using instruments like renewable energy certificates (RECs) and day-ahead and term-ahead contracts for the sale and purchase of power. On June 6, 2022, India saw the launch of its third power exchange as Hindustan Power Exchange Ltd. (HPX), promoted by PTC India Ltd, Bombay Stock Exchange (BSE), and ICICI Bank, and commenced operations after receiving all necessary approvals from Central Electricity Regulatory Commission.

REC Mechanism

Renewable Energy Certificates (RECs) enable distribution companies, open access consumers, and other entities to obtain renewable energy without upfront capital investment. The REC framework establishes a nationwide market for electricity generated from renewable sources, facilitating connections between producers across the country and discoms, corporate entities, and state utilities. It enables both private and state utilities to fulfill their Renewable Purchase Obligations (RPOs) by acquiring RECs from producers nationwide. Such a marketplace serves as a robust platform for expediting the adoption of renewable energy and ensuring the attainment of RPO targets.

CERC has established a regulatory framework for green power trading, primarily through the Renewable Energy Certificate (REC) mechanism. For every megawatt-hour (MWh) of renewable electricity generated and injected into the grid, the generator is entitled to one REC from the central registry, after registration and accreditation. RECs are valid for 1,095 days and can be sold on power exchanges regulated by CERC, which also fixes a price band to protect the interests of both generators and obligated entities. Furthermore, penalties are levied for shortfall in RPO compliance at the rate of forbearance price.

CERC also acts as the regulator for carbon credit trading, registering power exchanges for trading carbon credit certificates and ensuring the protection of buyer and seller interests. CERC regulates the Indian Power Exchanges through its CERC Power Market Regulations, 2021.

Green Term-Ahead Market (GTAM)

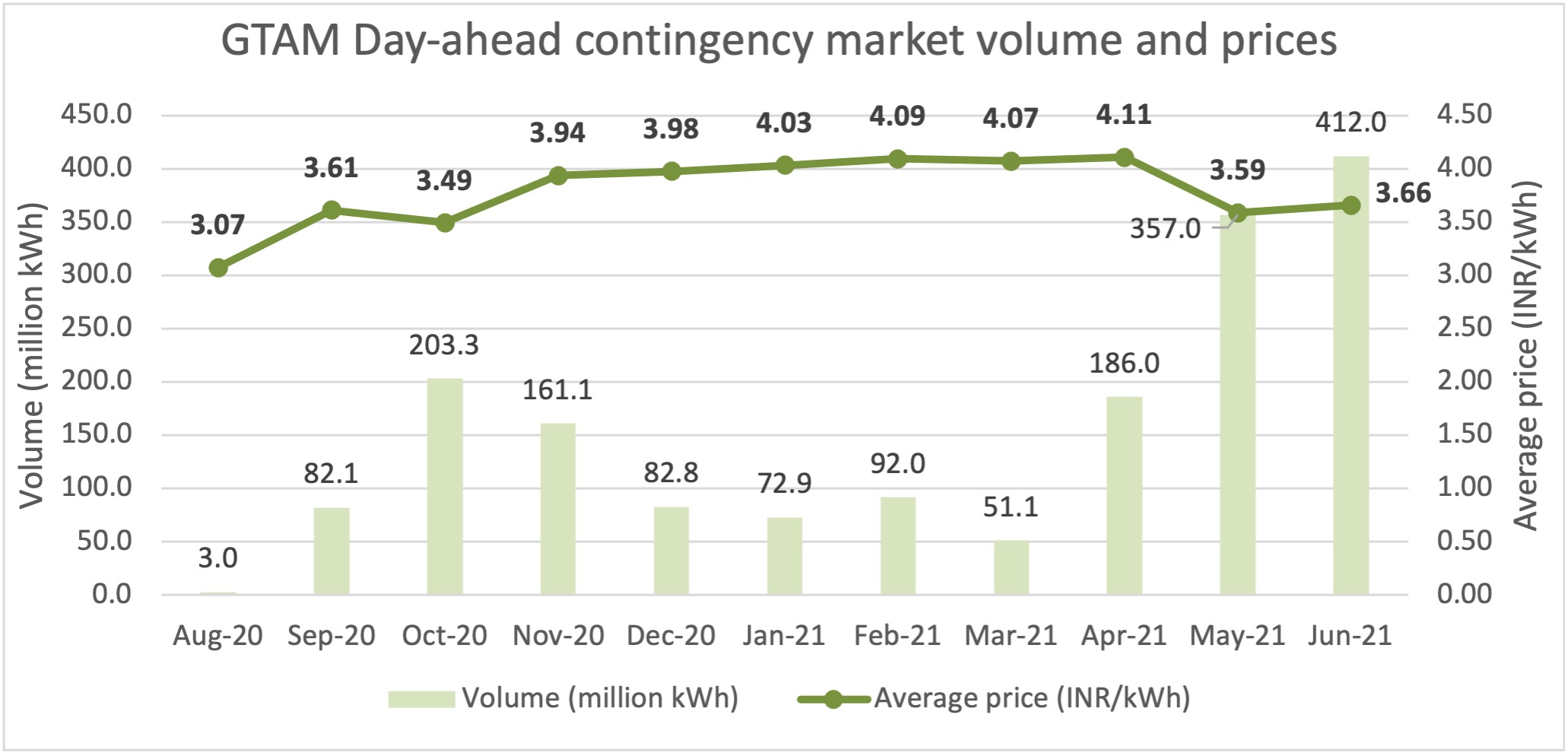

GTAM presents an alternative avenue for renewable energy trading, or green power trading, enabling producers to vend power in the open market without committing to long-term purchase agreements. Such flexibility benefits both producers and consumers within the exchange market. Following the introduction of a similar initiative by IEX in September 2020, PXIL also initiated the Green Term-Ahead Market (GTAM) in March 2021. This market encompasses both solar and non-solar electricity sectors.

The GTAM facilitates transactions between buyers and sellers through bilateral trading, covering four types of short-term contracts:

Intra-day contracts: These are 15-minute national contracts available for trading round the clock, with a cutoff time of 3.5 hours before delivery.

Day-ahead contingency contracts: These are 15-minute national contracts traded daily for electricity supply delivery on the next day from 0000 to 2400 hrs. The trading session occurs from 1500 to 2300 hrs. each day.

Daily contracts: These contracts are available for power trading on each trading day for electricity delivery on T+2 (T = trading day) day onwards. The contracts cover 15 minutes or a combination thereof from 0000 hrs. to 2400 hrs. The seller may revise the schedule by 0700 hours on D-1 (D = delivery day) with a deviation of up to 15 per cent.

Weekly contracts: These contracts are available for trading every Friday and Saturday for electricity delivery in the upcoming week from Monday to Sunday. Seller profiles are aggregated in MWh terms, and the seller may revise the schedule by 0700 hours on D-1 with a deviation of up to 15 per cent.

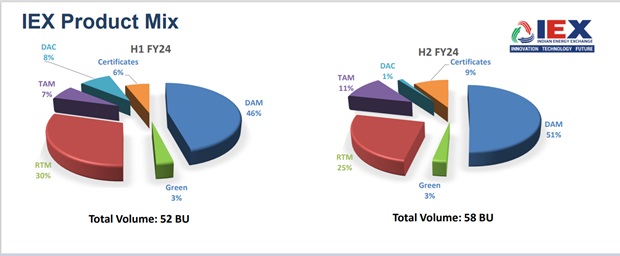

Share of products offered by IEX. Source: IEX Investors’ Presentation

Green Day-Ahead Market (GDAM)

In October 2021, the Ministry of Power and New and Renewable Energy unveiled the Green Day-Ahead Market (GDAM), establishing India as the sole major electricity market globally to adopt GDAM solely for green energy. GDAM guarantees prompt payment to renewable energy producers, enhancing its appeal as a catalyst for bolstering green energy trading.

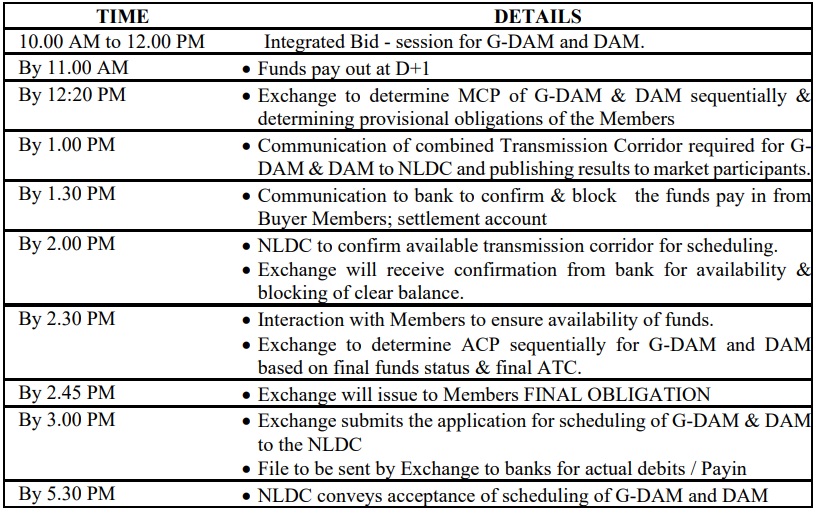

Trading in the Green Day-Ahead Market (GDAM) in India involves a series of steps that participants must follow. Here’s a simplified step-by-step procedure:

Eligibility Check:

Ensure you are eligible to trade in GDAM. Sellers should be generating electricity from renewable energy sources and have the necessary No Objection Certificate (NOC) or standing clearance from Regional Load Despatch Centres (RLDC) or State Load Despatch Centres (SLDCs). Buyers should be entities eligible to procure power through Open Access.

Registration:

Register with an energy exchange that offers GDAM trading, such as the Indian Energy Exchange (IEX).

Bidding Session:

Participate in the integrated bidding session for GDAM and Day Ahead Contract (DAC) which runs from 10:00 AM to 12:00 PM on all seven days of the week. You can opt to transfer unsuccessful bids from GDAM to DAC with the same or a different price.

Provisional Bid Matching:

After the bidding session, the power trading platform will attempt to match orders for GDAM first, followed by DAC, considering any uncleared bids from GDAM.

Provisional Market Clearing Price:

The provisional market clearing price (MCP) will be determined separately for GDAM and DAC based on the unconstrained scenario. Information regarding the provisional MCP will be sent to all members.

Delivery Allocation:

Based on the provisional solution, the exchange will send a combined requisition for Transfer Capabilities Verification and Reservation across different transmission corridors for the successful bids in GDAM and DAC.

Final Bid Matching:

The final bid matching process is based on the Available Transfer Capability (ATC) received from the National Load Despatch Centre (NLDC) and the funds made available by the members in their Settlement Account.

Settlement:

Once the final bid matching is done, the settlement process will begin, where the financial transactions are completed, and the delivery of the traded power is scheduled.

Delivery of Power:

The delivery of power takes place on the day after the trading session, hence the term ‘day-ahead’.