Highlights :

- GH2 cost of production needs to come down to around USD 1/kg compared to USD 3.74-11.7/kg cost of today to become economically viable alternative

- Inefficient infrastructure, storage risks, and water scarcity are other challenges to GH2 growth.

Heightened coverage Green hydrogen has been the new normal for over three years now. Many supporters have regularly drummed up its prospects, as a fuel that could decarbonise some of the most difficult to clean sectors of the economy. The skeptics have always asked one straight question. When, and at what price? Because, quite simply , the price and energy efficiency of the Green Hydrogen making process leaves a lot to be desired. For many optimists, 2025 was to be the year when the first signs would be visible, in terms of the viability of green hydrogen. 2025 is here, and well, we are not too impressed.

Even as countries like Australia, Germany, and Japan are already pushing hard to develop hydrogen hubs, there is a rising viewpoint that other than China and India, Green hydrogen cannot really be made at scale at the tight price possibly. Currently, GH2 is generally used in fuel cells to power vehicles and other heating systems. The rising demand for fuel cells in electric vehicles is expected to propel the global green hydrogen market size, which was calculated at USD 8.78 billion in 2024, as per GlobeNewswire report. It is expected to reach around USD 165 billion by 2033, growing at a CAGR of 38.77 percent from 2024 to 2033.

However, the International Energy Agency (IEA) suggests that the uncertainty around demand and incentives coupled with cost pressures are weighing on the global adoption of low-carbon hydrogen despite an uptick in final investment decisions in the past year. Calls are already being made to ‘subsidise’ faster growth. Those calls should be ignored, unless the authorities are bind to the many inefficiencies that still plague any hope of a bright future for the fuel. We list below five reasons why green hydrogen has not made a convincing case yet.

#1 Very Expensive Still

Cost competitiveness is crucial for any new technology to succeed in the fiercely competitive energy sector. For green hydrogen, it remains a significant challenge. GH2 has long been viewed as a viable replacement for grey hydrogen, derived from natural gas, with governments stepping in to provide the much-needed initial push. India’s Green Hydrogen Mission, with an allocation of INR 17,490 crore through 2029-30, serves as a notable example. However, recent developments have burst the bubble.

A significant implementation gap persists, with only 7 percent (0.3 GW) of the initially announced 4.3 GW from 190 green hydrogen projects launched globally between 2020 and 2023 being realised. High cost remains a major bottleneck and is set to further impact the sector’s promised growth. BloombergNEF’s new report on hydrogen prices finds that green hydrogen will fail to reach price parity with grey hydrogen by the middle of the century, as costs have more than tripled from last year’s forecast.

The cost of green hydrogen must significantly decrease from around USD 3.74-11.7 per kilogram (INR 323-1012/kg) today for its widespread adoption. At USD 1/kg (INR 138/kg), GH2 can become an economically viable option. This complicates the long term viability of green hydrogen for a preferred choice as the rising prices of electrolyzers could render GH2 to cost between USD 1.60-5.09/kg by 2050, with no easing of prices in the short-term in sight. On the contrary, grey (fossil) hydrogen currently costs between USD 1.11 and USD 2.35 per kilogram and is expected to remain so by the mid of the century.

To tackle this, billions of dollars have been invested into electrolyzer startups like Electric Hydrogen, Ohmium, Verdagy and EvolOH that promise to bring down the cost of green hydrogen production, with little visible impact.

#2 Where Will Water Come From?

Freshwater is scarce, and green hydrogen development increases competition for this vital resource, worsening global water scarcity. Uruguay’s recent crisis highlights this issue, with its worst drought in 74 years lasting over three years. By July 2023, Montevideo’s main water source, the Paso Severino Reservoir, dropped to 1.7 percent of its capacity, affecting a third of the population.

Producing hydrogen from renewable sources involves electrolysis of water. Thus, water scarcity is among the major challenges hindering green hydrogen future. Just the final stage of the stoichiometric process requires about 9-10 liters of water to create 1 kg of hydrogen. The overall requirement is several times more. This is particularly crucial for arid Gulf countries positioning themselves as key hydrogen hubs, such as Oman, Saudi Arabia, and the UAE.

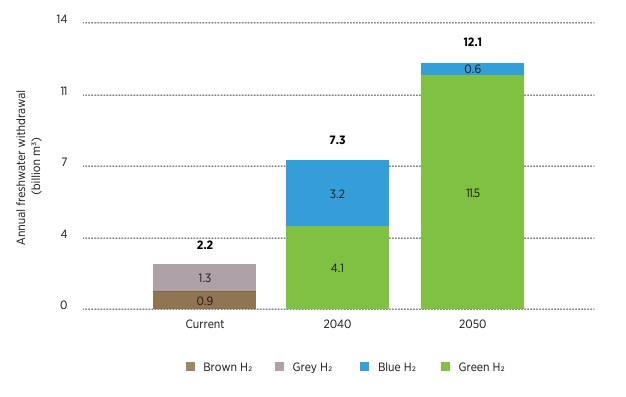

Current and projected freshwater withdrawal for global hydrogen production, by hydrogen production pathway

By 2040, IRENA’s 1.5°C Scenario predicts global hydrogen production at 247 Mt annually, with 166 Mt as green hydrogen and 81 Mt as blue hydrogen. By 2050, this rises to 523 Mt, with green hydrogen comprising 94 percent. The industry will require 7.3 billion cubic metres of freshwater by 2040 and 12.1 billion by 2050. Cooling will account for 61 percent of water use by 2040, and green hydrogen production for 26 percent.

This raises a serious question for the firms and policymakers looking forward to green hydrogen economies – how GH2 is expected to compete when as much as 50 per cent of the planet’s population is already dealing with water shortfalls at least one month of the year? And no, using desalinated or Sea water is not the solution it is trumpeted to be, for reason no. 3.

#3 Additional Energy Requirements for Desalination – Beyond Electrolysis

Given the scarcity of freshwater, the industry is turning to seawater desalination to support the green hydrogen surge while conserving freshwater. For example, the Indian Institute of Petroleum and Energy (IIPE), in partnership with NTPC Limited, is developing India’s first desalination-based hydrogen project. With a generation capacity of one tonne per day, the plant requires 10 tonnes of ultrapure water, necessitating the desalination of 300 tonnes of seawater. Yet, this approach also faces fundamental challenges.

While there are no major technical obstacles to desalination, the high energy requirements of this process pose a major challenge. Reverse Osmosis (RO) needs up to 6 kWh of electricity per cubic metre of water, though the latest RO plants such as in Perth, Western Australia, and Singapore use 3.5 kWh/m3, or 4 kWh/m3 including pumping for distribution. On the contrary, freshwater requires 2-3 kWh of electricity.

Currently, desalination plants are used in regions like the Middle East, which has a hot climate alongside a buoyant and technologically able economy. But the energy-intensive nature and high costs of conventional desalination plants act as barriers to widespread take-up.

#4 Storage Risks – Very Hard to Contain

Storing hydrogen efficiently remains one of the significant challenges for green hydrogen growth due to its low energy density. Conventional methods such as compressed or liquefied hydrogen come with efficiency and safety constraints, making large-scale storage complex.

Compressed hydrogen, stored in high-pressure cylinders or container racks, offers high-density solutions but is prone to leakage and poses safety risks, particularly during mechanical failures. Typical storage pressures range from 350–700 bar (5,000–10,000 psi), demanding robust materials and stringent safety standards. Pipeline storage also faces regulatory challenges and leakage concerns, while underground cavity storage, though theoretically viable, is restricted by geological limitations, high costs, and potential leakage issues, rendering it unsuitable for immediate use.

Liquefied hydrogen mitigates some risks by enabling lower-pressure storage and reducing leakage potential. However, it requires cryogenic temperatures (−252.8°C) to remain in liquid form, which demands significant energy input and highly insulated tanks to prevent heat loss and boil-off, complicating its adoption.

#5 Inefficient Infrastructure

The development of green hydrogen infrastructure faces significant global challenges, driven by gaps in existing systems, high costs, and technical hurdles. A key issue is the inadequacy of current gas pipeline networks.

For example, while Europe boasts an extensive 2.7 million km of pipelines, these are primarily designed for natural gas and require extensive retrofitting to transport hydrogen. Addressing hydrogen’s unique chemical properties, such as its smaller molecular size and risk of embrittlement, necessitates costly upgrades. These include replacing compressors and implementing leak mitigation measures. This complexity extends to other regions too with similarly outdated infrastructure, hampering the scalability of green hydrogen globally.

Cost is another substantial barrier. As per Hydrogen Infrastructure Report by Hydrogen Europe, EU alone estimates it will need €28–38 billion (INR 2,498–3,389 billion) for internal hydrogen pipelines and an additional €6–11 billion (INR 535–982 billion) for storage by 2040 to handle projected demand of 20.6 Mt of renewable hydrogen annually.

Developing countries and regions with limited infrastructure face even greater financial obstacles, as the initial investment needed to adopt hydrogen technologies can overwhelm their economic capacity.

A geographical mismatch between renewable energy generation and hydrogen demand further complicates infrastructure planning. Many regions with abundant renewable resources, such as offshore wind, are located far from industrial hubs with high hydrogen demand. This disparity necessitates long-distance transport solutions, which add to the cost and complexity.

Conclusion: All the signs point to a use case for green hydrogen that should be at site of production. Or requiring minimum transportation and storage needs. Talk of green hydrogen powered cars and more should frankly be junked in favour of more proven and cost efficient options, including basic issues like improving public transport.